Half Baked: TX Group

Preamble: TX Group is a relatively complicated company, with many moving parts. This memo is meant to be a bare-bones explanation of why I own it.

TX Group (TXGN) is a Swiss media company.

The first thing you need to know about TXGN is that the majority of its revenue comes from legacy newspaper operations.

The second thing you need to know is that this is a '“sum of the parts” thesis.

OK so now that I lost about 90% of you guys, let’s get into it. The thesis involves 3 parts:

The shares trade at a very heavy discount.

The vast majority of the NAV comprises highly profitable online media / marketplace businesses.

The crown jewel asset - Swiss Marketplace Group - is going through a classic post-merger margin expansion phase.

PART 1: THE DISCOUNT

Let’s start with the simple part:

TX Group has 10.6m shares outstanding. There are no dilutive shares.

At its current price of CHF85.80 per share, its market cap is CHF910m.

What do we get for this? As of 2023 H1 (June 30th):

Cash and other financial assets of CHF282m

Loans receivables of CHF249m

30.7% ownership in Swiss Marketplace Group (SMG), last valued at CHF2.7B

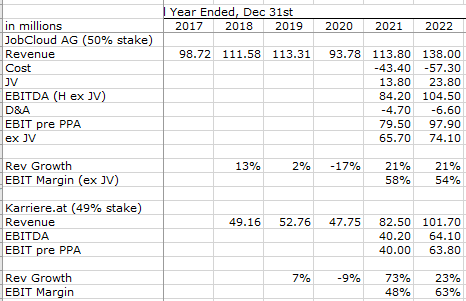

50% ownership of JobCloud, FY22 EBITDA of 100m.

49% ownership of Karriere, FY22 EBITDA of 64m.

Legacy newspaper operations: Tamedia, 20 Minuten, including real estate assets.

Goldbach, a media / advertising agency.

Let’s validate some of the numbers:

Cash - held at Swiss banks.

Financial Assets:

Current: 19m, in securities. As of FY22, most of this was in-time deposits and bond funds.

Non-Current: 41m in equity instruments (private investments) and 170m in loans receivable. Interest rate likely to be sub 5%.1

The majority of loans receivable is to General Atlantic, related to the SMG transactions. The loan is secured by SMG shares.

Liabilities: TX Group reports leases as ‘financial liabilities’ - backing this out, the group has 25m of purchase obligations and no other debt.

Swiss Marketplace Group’s valuation comes from the 10% stake sold to General Atlantic in 2021.11, for 270m. Since this is a stale number, from the peak, we will come up with our own valuation number below.

If you’re following, 50%+ of the market cap is covered by cash, financial assets, and loans receivable. Or - SMG value alone gets you to ~90% of the market cap.

PART 2 & 3: THE ASSETS

Aside from cash and loans receivable, we also get a laundry list of assets.

The most valuable of these are SMG, JobCloud, and Karriere. Brief descriptions follow below:

Swiss Marketplace Group:

The group was formed in late 2021, via a merger of TX Markets and Scout24 Switzerland.

The group owns a variety of marketplace businesses across real estate, auto, general, and finance verticals. It has a leading market position in all verticals except finance.

A full deep dive into this unit is beyond the scope of this note. If you’re interested in learning more about this group in depth, please see the attached presentation (pg43+), and transcript (pg13+).

There are two crucial points to understand here.

Leading marketplace businesses tend to be highly profitable, with EBITDA margins of ~50%+ and very little CAPEX.

Marketplace mergers of equals tend to be one of the surest ways to generate tons of value. There are many duplicate costs to take out across the group, and there are massive marketing synergies. We are seeing this play out in real-time.

Now - even though the last mark was at CHF 2.7B, this was done at the height of the post-COVID bubble. Let’s come up with a more conservative estimate.

What might margins top out at, and what is this business worth?

Dominant marketplace businesses have margins in the 50-75% range.

They trade at 6-10x revenue

If margins get to 45%, and this trades at 13x EBITDA / 6x revenue, SMG would be worth CHF 1.7B.

TX Group’s current stake will be worth CHF 520m.

JobCloud and Karriere

These two units are leading job marketplaces in Switzerland and Austria, respectively.

They are relatively mature businesses. Short financial snippets follow:

One of the key questions you may have is: are 2022 earnings sustainable? I don’t know. However, even at pre-COVID levels of CHF100m & CHF 50m revenue, at 50% margins, at 10x EBIT, gets us to CHF 750m of value. TX Group has 50% stakes in both companies.

Note that an Australian comp - SEEK Limited, trades at ~16x EBITDA, with huge CAPEX, for mid-single-digit revenue growth rates.

Adding it all up, we get a relatively conservative estimate of NAV at ~CHF1.4B or a 37% discount to NAV at current prices.

If we were more aggressive with assumptions: using 15x EBITDA on SMG, or using current earnings + higher multiple on JobCloud + Karriere, NAV could easily hit CHF 2B.

RISKS / WHAT COULD GO WRONG?

There are two potential scenarios where you could lose a lot of money here.

Management blows all of the cash.

Usually, this risk point contains some long prose about management character, culture, and how an intense 2-hour discussion with the CEO about Charlie Munger’s mustache led you to develop a deep sense of trust.

Unfortunately for you, I don’t have any of that.

There are some crumbs we can analyze here, which are relatively positive:

The majority of historical acquisitions came from consolidating market position in the marketplace verticals, between 2013-2016. While I do not have a full analysis, given the amount spent and the current value of SMG, it’s likely that they created a decent amount of value here.

The SMG deal itself - consolidating market share in a single country - was a highly accretive move.

They recently spent CHF 100m in buying a billboard business from Clear Media in Switzerland. Details are scarce so it’s tough to know if it was a good deal or not.

But make no mistake. TX Group is family-controlled, and there’s not much to analyze here. Even if we had reams of information, one big move could invalidate the entire thing.

Given this - the best way to deal with this would be to analyze deals as they come.

Unless management literally steals the cash - any deal announcement is unlikely to send the stock down massively.

Legacy businesses are worth -CHF500m.

One sneaky thing I did above is avoid analyzing the legacy newspaper businesses.

As far as I understand, in Switzerland, newspapers are still relatively important with a very high readership, due to the importance of local politics. Nevertheless, these are still declining businesses.

These units are still profitable (barely), and the decline rates are not bad - outside of COVID year, revenue has been relatively flat.

However, they are still newspapers - and it’s very possible that they end up being worth less than 0. The decline rate and the pace of cost-cutting are something to watch for.

Other scenarios that I’m less worried about:

There is no value realization: This is less of a risk. The management team has talked about listing SMG at some point, and there are plenty of buyers for marketplace assets. But even if it never got sold/listed, there are enough underlying earnings here to back up the valuation.

General Atlantic defaults on the loan: the loans are secured by SMG shares.

TX Group is a 6% position in Panoramic Capital.

While the interest rate is not disclosed in the annual report, TXGN reported an interest income increase of CHF6.4m in 2022, related to loans.

![[redacted]'s avatar](https://substackcdn.com/image/fetch/$s_!lWn2!,w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F17d07f92-f7cb-4c47-8487-c12ee130769c_3419x3021.jpeg)