Rover

TL;DR

Quality: A dominant marketplace business.

Growth: Currently growing at ~40%. Growth will decelerate, but it has a long runway to continue growing at double digit rates.

Value: <2.5x EV to revenue. Cash neutral1, inflecting towards profitability. Aims for ~30%+ EBITDA margins. Dominant marketplaces typically earn 50%-70% profit margins at maturity.

Con: it’s a deSPAC tech co, with decelerating revenue growth.

INTRODUCTION

Rover is a peer to peer marketplace business that connects pet parents with service providers. The platform is full featured. It handles everything from search, booking, chat, and payments.

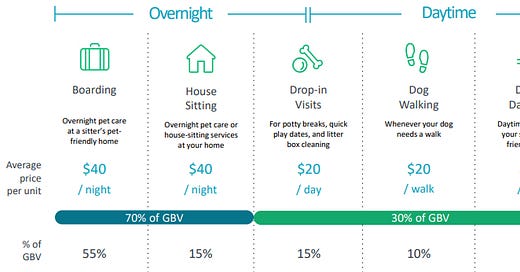

While the platform allows for a variety of pet related services, the majority of the gross booking value comes from overnight bookings.

Rover generates revenue by charging a booking fee to pet parents, and a take rate to service providers. As of 2022 Q3, the total take rate was ~22% of gross booking value.2

Rover currently earns most of its revenue from North America, though it is expanding quickly in UK/Europe.

SUMMARIZED THESIS

1) Rover is a high quality marketplace business

Fragmented demand and supply: Rover sits at the centre of a very fragmented supplier and user base. As of 2022, Rover connected ~1m+ pet parents, to more than 320k service providers. 98% of service providers are non-professionals that are doing it to earn a bit of extra income (~$2.2k/yr on avg).

Dominant: Rover is “the” marketplace for pet sitting. The company’s closest competitor is Wag!, whose GBV is <1/8th of Rover’s, and is focused on-demand dog walking vs overnight boarding3.

No good alternatives: Neither pet parents nor service providers have good alternatives.

For pet parents, Rover is akin to AirBnB for pets… if OTAs didn’t exist (Wag! is the only other website), hotels were like prisons (look up photos of kennels), and the only alternative was to beg your parents or friends to let you stay with them.

Even if you have a willing friend/family member, they need to live somewhere that can accommodate your pet, and be free the entire time you’re gone. You’ll also feel awkward sending specific care instructions to someone doing you a favour. (Ever tried asking your in-laws to brush your dog’s teeth every night?)

For service providers, while there are alternate advertising channels available, it will be much more difficult to find pet parents who are willing to pay you to board their pets.

No labour issues: Unlike Uber or Doordash, Rover doesn’t rely on the “gig economy”, and doesn’t face similar labour issues.4

2) Rover is growing very quickly, with a long runway ahead

As the chart below shows, Rover is still in its fast growth phase. For 2022 Q3, the company grew its revenue by 45%, on a recovered comps period.

Now, this growth rate will definitely decelerate next year. FY22 growth includes quite a bit of average booking value growth, due to service providers raising prices in line with inflation. Nevertheless, booking volumes are still growing at high teens+ rates, and saturation point seems long way off:

90% of pet care is still provided by friends and family. While they will remain the primary choice, there’s plenty of room for Rover to grow while still being a “niche solution.”

Rover’s services are broadly used across city, age, and income brackets, as per the slide below:

Rover launched in UK / Europe in 2018, and is currently growing at 100% yoy, albeit off of small figures.

3) Economics of a mature, dominant marketplace business is extremely attractive

High-value add marketplaces with dominant market shares are essentially license to print money, for a few reasons:

High gross margins: marketplaces don’t really “sell” anything - it’s a media business, and as such, typically sport very high gross margins.

Simple operations with high operating leverage. Marketplace businesses are simple operations. Once you become “the place to go”, you just have to maintain the status quo.

Marketing costs often decline rapidly as you become the dominant player, as network effect ensures that buyers and sellers naturally gravitate toward the platform.

There’s fair bit of pricing power. As the only player in town, you can charge high prices for using the platform.

Rover exhibits all of these features. Gross margins are high (80%), marketing costs are falling rapidly, with a strong source of “free” customer acquisition, as per the chart below, and we’ve seen fixed costs such as G&A and R&D costs start to fall as % of revenue recently.

The company is aiming for 30%+ EBITDA margins. I think it can do a lot higher. Check out these EBITDA margins for other, mature, dominant marketplace businesses.

Rightmove, UK property portal: 75%

AutoTrader UK, UK used car marketplace: 71%

Hemnet, Swedish property portal: 54%

Adevinta France, a general classified site: 47%

Whatever the number ends up being, Rover is very likely to be a highly profitable business.

4) Low valuation

Given the quality, growth, and potential margins, Rover is trading at a very low price today.

The company’s market cap is $716m, including dilutive shares.

It has a cash balance of $235m. Some of this is working capital cash, as pet parent deposit fluctuates intra-year. But the vast majority of it is unencumbered. The company is broadly cash neutral.5

The company is expected to do $172m in revenue this year, and ~$221m in FY23. Even if they miss estimates by a huge amount, it’s trading at <2.5x EV/Rev, or 8x company’s target EBITDA margins.

KEY RISKS AND ISSUES

Travel-dependent:

Rover’s revenue model is bookings driven. The main driver of its services is vacation related travel.

If we hit another lengthy mass travel disruption event in US, it’s going to be ugly.

Margin achievability:

While theoretically, Rover should be highly profitable, this depends on management’s spending discipline, and shareholder treatment.

The company is currently ramping up margins, and it’s hard to imagine Rover blowing through its balance sheet right after coming out of COVID. Nevertheless, as much of the spending is discretionary, we won’t know what mature margins look like until we get there.

SBC is definitely a factor when considering terminal margins. The company reserved 17m shares (<9% of shares outstanding) for its 2021 equity incentive plan and ran through about 60% of it in the last 7 quarters, so overall dilution isn’t a deal breaker, but something to watch out for.

Service provider onboarding and churn:

While Rover isn’t a gig economy company, it still relies on a new breed of suppliers - those that are willing to take care of other people’s pets for a bit of extra income.

As a result, the company has a slightly tricker growth dynamic than other marketplaces. Rover has to create supply by onboarding service providers. Rover has been pretty good at doing this so far, but it’s unclear where this taps out.

Unfortunately, Rover does not report supplier churn numbers. However, this is expected to be high. Rover notes that over 800k care providers have been paid, with there being 320k active providers today.

Rover is a current holding of Panoramic Capital.

Because of working capital swings, FCF numbers swing around intra-year.

Company reported. Adjusts for deferred revenue.

Also note that this is after racking up ~$150m in accumulated deficit to compete with Rover.

Despite this, the company did get sued for “gig work” issues - this was recently settled for $18m.

Co generated 7m of FCF in 2021. For FY22 9 months, FCF was negative $10m or so, but working capital swings lawsuit settlement numbers affect this. The base business should be cash generative in FY22 as well.

![[redacted]'s avatar](https://substackcdn.com/image/fetch/$s_!lWn2!,w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F17d07f92-f7cb-4c47-8487-c12ee130769c_3419x3021.jpeg)